Traveling is one of life’s most enriching experiences. Exploring new destinations, immersing yourself in different cultures, and creating lasting memories are all part of the adventure. However, amidst the excitement and anticipation of your next trip, it’s easy to overlook an essential aspect of travel planning: purchasing travel insurance. In the over 25 years Go Get Lost has been in business, we’ve seen many, many cases where people were either thankful they purchased travel insurance or were disappointed they did not purchase it.

For us, two of the most common reasons we see that prevent a person from traveling is a death in the family or an injury or medical condition that arises before their tour. For most, they have a significant investment in non-refundable expenses, such as deposits, airline flights, hotels, etc. Because the expenses are non-refundable, without travel insurance they are simply lost. For two travelers, it’s not uncommon for the amount to exceed $10,000 – $15,000.

Not only have we seen things happen before the tour, but we also see them happen while on the tour. It can be something as simple as a broken ankle, or something more serious such as a brain injury. This is why travel insurance not only helps before the trip, but helps after the trip has started, providing medical coverage while you’re away.

In this article, we’ll explore why travel insurance is vital and discuss important factors to consider when selecting the right policy for your journey.

Why is Travel Insurance Important?

1. Protection Against Unexpected Events

While no one likes to dwell on the negative aspects of travel, the truth is that unexpected events can and do happen. Travel insurance is your safety net when things go wrong. It can provide coverage for a wide range of unforeseen situations, including trip cancellations, medical emergencies, lost luggage, and even natural disasters. Without insurance, you might find yourself in a difficult and expensive situation that could have been easily avoided. When thinking of potential dangers on a trip, most people think in terms of catastrophic events related to the type of travel…those hiking in the mountains envision a fall off a cliff, those on an African safari wonder about a wild animal attack. But in reality, in the unlikely event an accident does happen, it’s much more mundane. You slip in the shower at the hotel…your taxi gets in an accident on the way to the airport…or maybe a pre-existing condition flares up again. The same common accidents and illnesses that happen at home just happen to occur while on vacation in a foreign land. The only difference (and it’s a HUGE difference) is that you are not in the United States, with its amazing, advanced medical system.

2. Peace of Mind

Travel can be stressful, and knowing that you have a financial safety net in place can provide peace of mind. With the right insurance policy, you can enjoy your trip without constantly worrying about potential mishaps. Whether it’s a minor illness or a major travel disruption, you’ll have the assurance that you’re financially protected.

3. Medical Coverage Abroad

Your health should be a top priority when traveling. International medical bills can be exorbitant, and in some countries, healthcare may not be readily available. Travel insurance often includes coverage for medical emergencies, ensuring that you receive the necessary treatment without incurring overwhelming expenses. This is especially important if you have pre-existing medical conditions or require specific medications. One thing Go Get Lost always includes when quoting travel insurance is “Hospital of Choice”. Essentially this is an inexpensive upgrade that helps you get to your hospital of choice, rather than the “nearest adequate medical facility”. When traveling internationally, it’s important to consider where a medically necessary procedure might take place. For us, we want the choice of returning to the United States if any critical medical procedure needs to be done. Be aware that this upgrade does not give you “carte blanche” to be transported anywhere you want, for any reason. If your condition is too serious for transfer, or too trivial for international transfer, than the local doctors (and insurance company) will not sign off on it. But for the majority of injuries and illnesses it DOES give you much more control over which medical facility you are being transported to.

4. Trip Cancellation and Interruption

Life is unpredictable, and sometimes you need to cancel or interrupt your trip due to unforeseen circumstances. Travel insurance can help you recover non-refundable expenses, such as plane tickets, hotel reservations, and tour bookings. Whether it’s a family emergency, illness, or a job-related issue, having insurance in place allows you to reschedule or recoup your losses.

5. Coverage for Lost or Stolen Belongings

Losing your luggage or having valuable items stolen can quickly turn a dream vacation into a nightmare. Travel insurance can cover the cost of replacing lost or stolen belongings, including passports, cameras, and electronics. This coverage can be a lifesaver when you’re far from home.

6. Medicare Coverage Outside the United States

In most situations, Medicare won’t pay for health care or supplies you get outside the U.S. The term “outside the U.S.” means anywhere other than the 50 states of the U.S., the District of Columbia, Puerto Rico, the U.S. Virgin Islands, Guam, American Samoa, and the Northern Mariana Islands. If you are on Medicare and are traveling outside the United States, you essentially have no coverage unless you have additional insurance beyond the base Medicare coverage.

What to Consider When Purchasing Travel Insurance

1. Trip Details

Before you purchase travel insurance, it’s essential to know the specifics of your trip. Consider the destination, duration, and activities you have planned. Some policies are tailored for specific types of travel, such as adventure sports or international cruises. Make sure your policy matches your trip’s characteristics.

2. Coverage Options

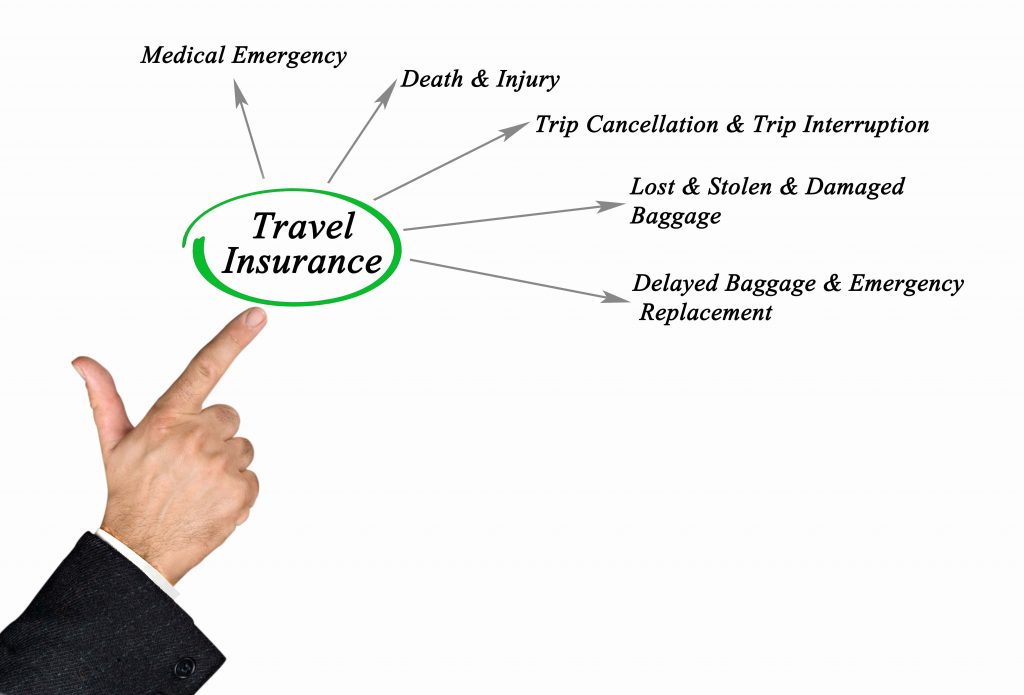

There are various types of travel insurance coverage available. Common options include trip cancellation/interruption, medical, baggage loss, and emergency evacuation coverage. Review the inclusions and exclusions of each policy to ensure it meets your needs.

3. Pre-Existing Conditions

If you have pre-existing medical conditions, be sure to disclose them when purchasing travel insurance. Some policies may exclude coverage for these conditions, while others may offer coverage with certain conditions. Be transparent about your health to avoid any issues when making a claim. Also, it’s not uncommon for travel insurance providers to have timelines on when you purchase your insurance to get Pre-Existing Medical Condition coverage. For example, most insurance providers require you to purchase your insurance within 15 days of purchasing your trip and any additional add-ons. Remember, this pre-existing conditions coverage often applies to those around you that could prevent you from traveling, for example a family member passes away from a pre-exiting medical condition.

4. Policy Limits and Deductibles

Understand the policy’s limits and deductibles. These are the maximum amounts the insurance company will pay out and the amount you need to cover before the insurance kicks in. Ensure these limits are sufficient to cover your potential expenses.

5. Compare Policies

Don’t settle for the first travel insurance policy you come across. Shop around, compare different policies, and read reviews to find the best coverage for your needs. Consider factors such as the reputation of the insurance company, customer service, and the ease of filing claims. Be especially careful about “free” policies that are included with airline tickets or offered by credit cards. Often these policies are very minimal, and are worth exactly what you paid for them.

6. Covered Reasons

Make sure you understand the “covered reasons”. These reasons guide you on when and when you are not eligible to file a claim. It’s the “why” when making a claim. For example, a death of a parent, loss of job, death of a travel companion. It’s critical to understand the various covered reasons of your plan and whether or not likely reasons you might cancel are covered. If a likely reason is not covered, you may consider a “Cancel for any Reason” policy. These policies give you the most flexibility when cancelling, but also come with the highest price. In addition, many cancel for any reason policies do NOT cover the full amount of what you have paid, so pay special attention to coverages.

7. Travel Insurance Providers

Choose a reputable and well-established insurance provider. Read customer reviews and check their financial stability to ensure they can fulfill their commitments in case you need to make a claim.

Purchasing travel insurance is an essential aspect of responsible travel planning. It provides peace of mind, protects you from unforeseen events, and ensures that you can enjoy your journey without financial worries. Before embarking on your next adventure, take the time to explore your insurance options, understand the coverage, and choose a policy that suits your needs. Remember, when you’re well-prepared, you can fully savor the joy of travel, knowing that you’re safeguarded against unexpected bumps in the road.

Go Get Lost has been partnered with Travel Guard for over 20 years and we continue to recommend them to our clients. There are many providers, take your time and find the one you are most comfortable with.